If you were scratching your head when Patagonia sold off its military contract sewing division named Forgeline Solutions earlier this year, then this latest move by founder Yvon Chouinard will help connect some dots.

Billionaire Chouinard has given up the whole kit and caboodle, announcing that Patagonia is restructuring and will be managed by two new entities. The first is Patagonia Purpose Trust, which will own all of Patagonia’s voting stock. The second is Holdfast Collective, a nonprofit which oversees Patagonia’s environmental activism. 100% of any profit not reinvested in the business will be turned over to Holdfast Collective, a sum expected to exceed $100 million annually. Holdfast Collective is a 501(c)(4) charity which is allowed to make donations to political causes.

In an online post entitled, “Earth is now our only sharholder” Chouinard spells out his reasoning.

As much as things are changing, much will also remain the same. Patagonia will remain in Ventura, California, CEO Ryan Gellert gets to keep his job and the Chouinard family will remain on the board as well as heavily involved in the charity. In fact, Chouinard along his wife Malinda, and two children, Claire and Fletche had to donate their company shares to Patagonia Purpose Trust.

Something very interesting was pointed out to me about this move. As much as Chouinard has heralded left wing causes over the years, he never offered an employee stock option. If he had, this whole thing would have been impossible.

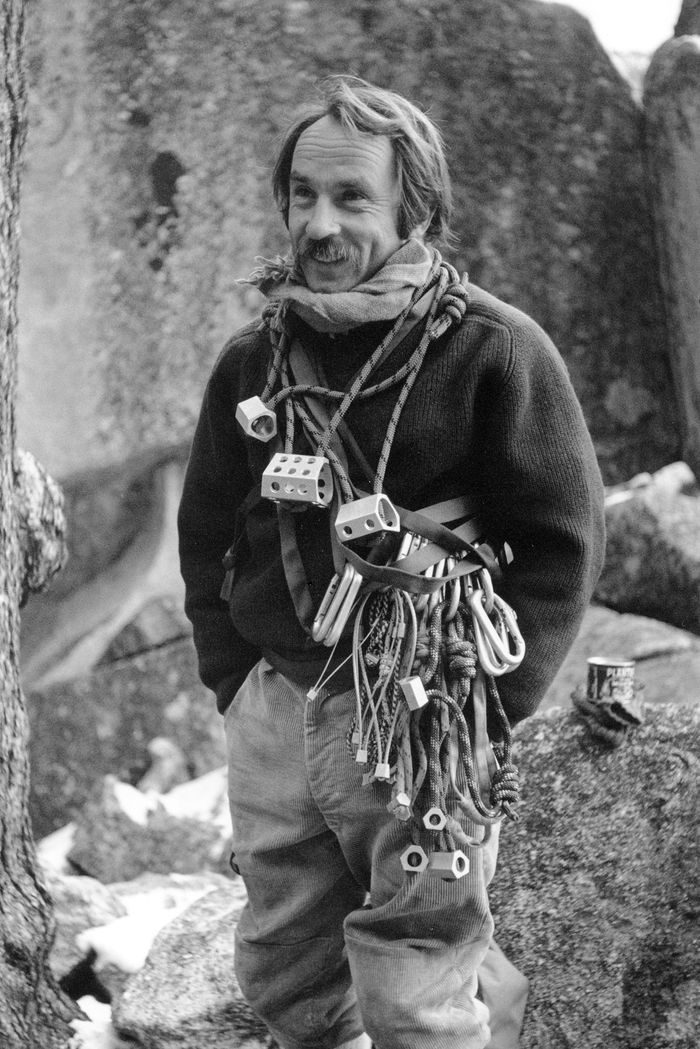

Photo by Tom Frost

Like that brand or not, Yvon remained steadfast to his values, all the way to the bank.. or out of the bank. Impressive.

The collectivist socialists made their exit years ago with Black Diamond.

More of this…

I quit buying patagucci crap decades ago.

I remember when yvon was pounding pitons out in his shop in Ventura, CA….I guess the fumes got to him

Cool story bro.

I respect a man who is willing to stick to his values and decides that his wealth is transitory and can be used for the greater good – stewardship of the planet.

Well said

Clever rich-staying-rich tax dodge? Somebody school me here.

Not sure how paying $17.5 million in additional taxes due to gifting their shares to a trust counts as “tax dodging”.

They’re still on the board and well employed. The Chouinard family isn’t going to starve.

My guess is tax reduction as well as a bit of estate planning.

B Corp seems to be taxed at the same rate as C corp, which has been around 20% since 2017(It was about 35% before). That is about to change with current administration looking to increase the corporate tax rate to 28%. Also, C corp may get long term capital gains taxes as ordinary income. Ordinary incomes get taxed at higher rate than capital gains.

By moving the shares to a trust, capital gains can be taxed at 20%. Additionally, when the founder passes away, there might be less headache for heirs in both tax and legal area.

I am not a tax specialist, lawyer, accountant, or else.

What an absolute GOAT. Way to put your money where your mouth is.

I wonder when Patagonia is going to stop using synthetic fabrics made from dirty crude oil???

Employee stock options is not a Left Wing Ideal. Although to be fair the entire Left vs Right is a false dichotomy at best.

Employee stock options is not a “Left Wing Ideal”. Although to be fair the entire Left vs Right is a false dichotomy.

The Bloomberg explanation;

https://www.bloomberg.com/news/articles/2022-09-15/patagonia-billionaire-who-gave-up-company-skirts-700-million-tax-hit