INMAN, S.C. – April 7, 2021 – TrueTimber and American Honda have joined forces to form an amazing partnership of two world-renowned brands. Working side-by-side, the two industry leaders have developed new, special edition off-road vehicles as well as a co-branded line of outdoor apparel featuring the TrueTimber Viper Urban camo pattern. These special edition Honda Talon and Pioneer models, accompanied by the performance lifestyle apparel, will be available to consumers in the Summer of 2021.

“It’s really incredible to watch what we have been able to create through this partnership and it has been great getting to work hand in hand with a brand like Honda,” said TrueTimber CEO Rusty Sellars. “Honda is a premier name in the powersports industry, and we are thrilled to announce TrueTimber fans can now find Honda side-by-sides in TrueTimber camo. With Honda’s ability to offer top of the line off-road vehicles, paired with our capabilities in producing performance apparel, this partnership is off to an impressive start and looks to have a very bright future.”

The new special edition (SE) versions of both two- and four-seat Talon sport side-by-sides, and both three- and five-seat Pioneer 1000 multipurpose side-by-sides, come pre-installed with accessories some customers typically add after the initial vehicle purchase. These flagship trim levels add value by saving money and improving comfort and convenience, and they help drivers explore further. Owners will also stand out from the crowd, thanks to exclusive TrueTimber Viper Urban camo graphics now available through this special collaboration.

“As well as Honda’s Talon and Pioneer 1000 perform, there are some drivers who demand even more, and they typically pursue that edge through accessories,” said Brandon Wilson, Manager of Advertising, Sports and Experiential at American Honda. “We’re pleased to help those customers extend their adventures, while also saving money and time. These Special Edition versions of our flagship side-by-sides are already outfitted with components that previously could only be added after the initial purchase. The icing on the cake comes in the form of striking Viper Urban Camo graphics, which ensure these Special Editions look the part.”

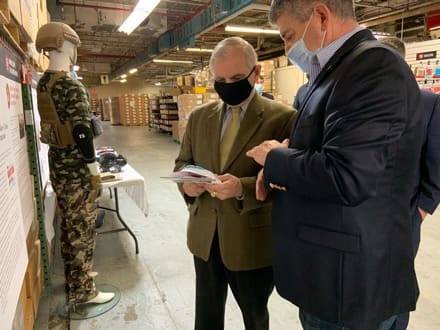

The co-branded clothing line features aspects of both Honda and TrueTimber, to create a truly spectacular, unique product line, made to withstand any adventure. Proven and trusted TrueTimber performance materials are utilized on all garments, to create adventure ready apparel that is both stylish, and tough as those who will be wearing it. Select pieces feature TrueTimber Viper Urban camo accents to flow seamlessly with the special edition side-by-side models.

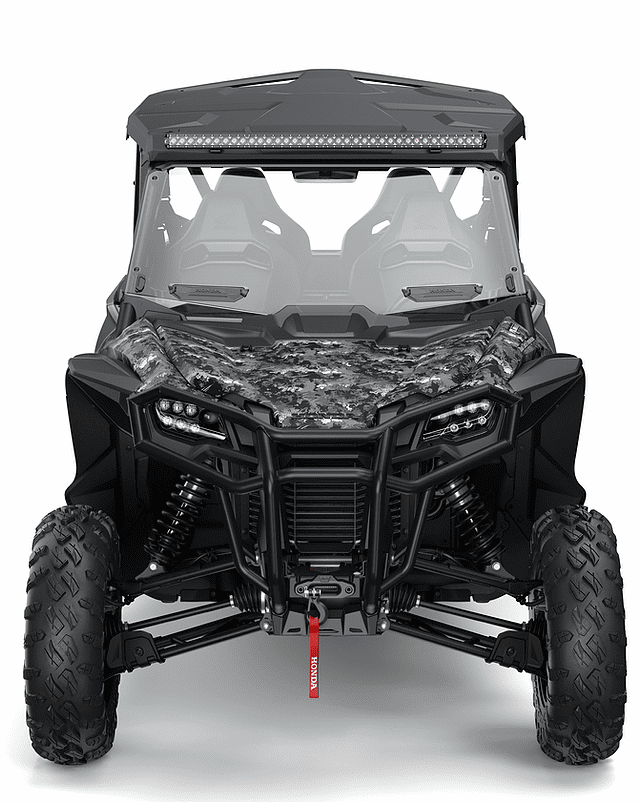

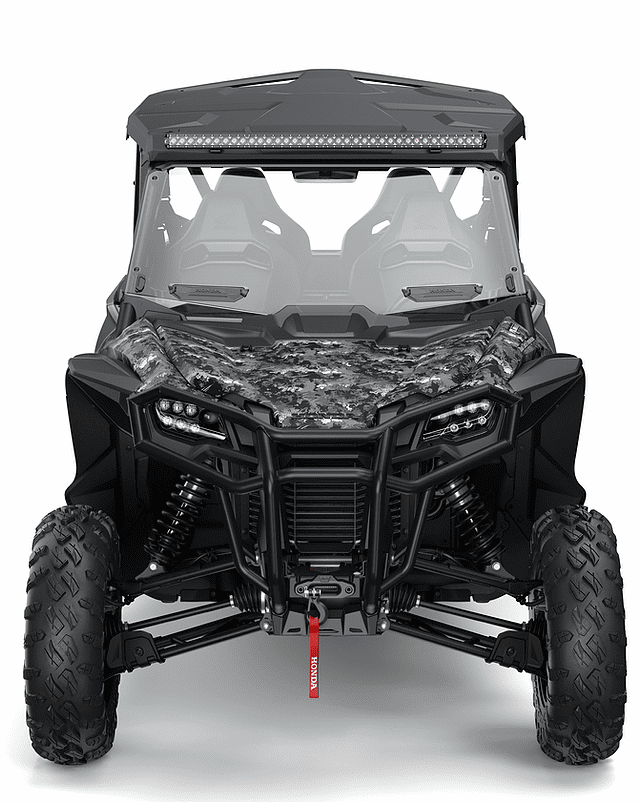

2021 Talon 1000R SE / Talon 1000X-4 SE

Designed with off-road excitement, precision and quality in mind, the Talon 1000 platform is a fusion of Honda’s experience in two- and four-wheel design and racing, pushing the envelope of what is possible in a production sport side-by-side. Nonetheless, customers who are only content to be in front of the pack sometimes modify their Talons with accessories to improve performance and style. Honda is now offering Special Edition trim levels of the 1000R two-seat and 1000X-4 four-seat Talons, ready to go with accessories already installed. Upgrades include a front bumper, winch kit, vented windscreen, light assembly, rear-view mirror and door lowers, adding real value and convenience to an already capable machine.

• Color: Viper Urban Camo

• MSRP

Talon 1000R SE: $26,099

Talon 1000X-4 SE: $26,999

• Info

Talon 1000R SE

Talon 1000X-4 SE

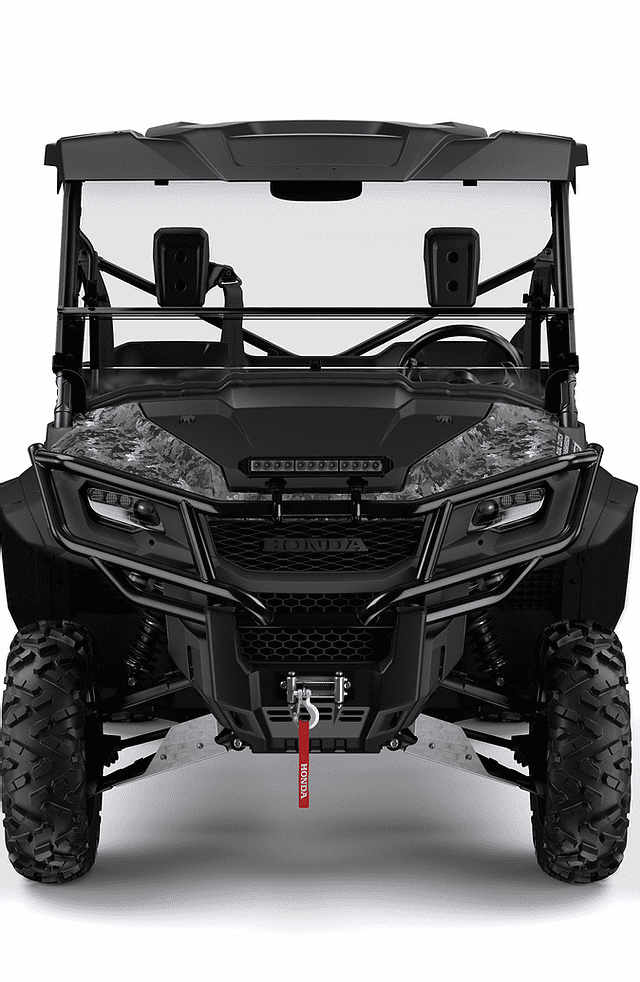

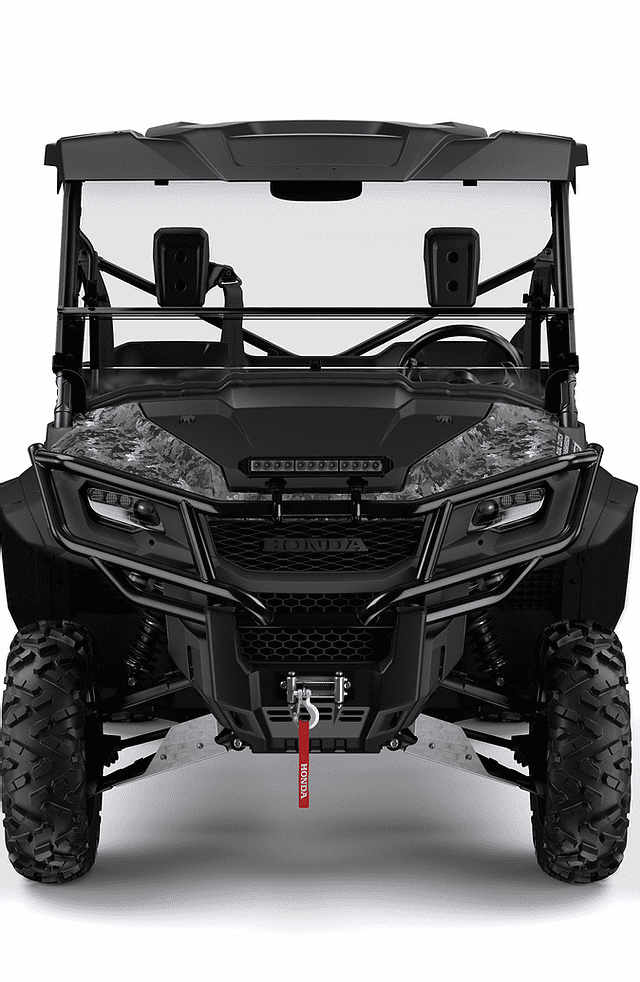

2021 Pioneer 1000 SE / Pioneer 1000-5 SE

The industry’s benchmark multipurpose side-by-side, Honda’s Pioneer 1000 is an ideal option for work or play, blending comfort, handling and hauling with user-friendly features like an automatic six-speed Dual Clutch Transmission. Still, many owners opt to equip their Pioneers with accessories after the initial purchase. Now, Honda is offering Special Edition trim levels that come from the factory with many of the most common upgrades already in place, ultimately saving those customers time and money. Offered for both the three- and five-seat versions of the Pioneer 1000, the SE option adds real value, improved performance, visual flair and the capability to go and explore further, thanks to accessories including a roof, windscreen, fender flares, winch kit, rear-view mirror and LED light bar.

• Color: Viper Urban Camo

• MSRP

Pioneer 1000 SE: $21,999

Pioneer 1000-5 SE: $23,999

• Info

Pioneer 1000 SE

Pioneer 1000-5 SE

To find more information on the Honda and TrueTimber partnership, view the special edition models, or shop the co-branded clothing line, please visit: TrueTimber.com/Honda.