Huntington Beach, CA, January 13, 2023 – DEVCORE, a leading tactical softgoods brand and division of ABX Group Inc, is excited to display new products at the 2023 Shot Show in Las Vegas, Nevada and announce its collaboration with Drift Dry USA, high end manufacturer of gear and accessories for the outdoor and dive markets. Visitors may visit Booth 61411 at the Venetian Expo to see all the latest products.

To serve those who require high performance hand protection in cold weather conditions, DEVCORE will be showcasing its Summit Combat Glove, Summit 3 Finger Mitten System, and Summit Combat Snow Gaiters. Both the Summit Combat Glove are designed to work together, giving users versatility to accommodate operational needs. The Summit Combat Snow Gaiters have already been issued to various military units due to the superior design and weather protection.

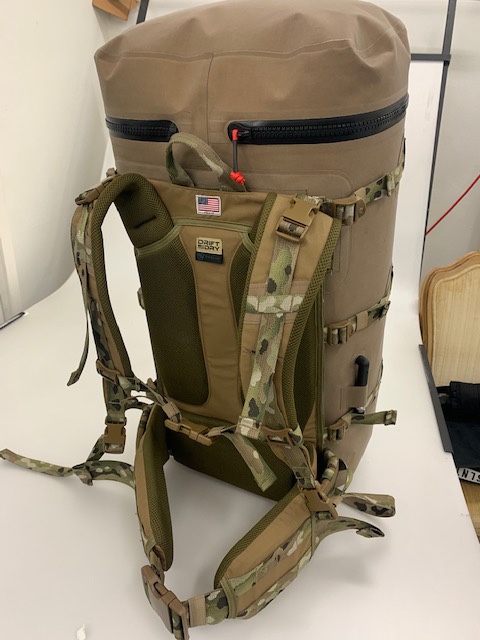

DEVCORE is also excited for its collaboration with Drift Dry USA, to bring co-branded and co-designed products to the market.

“Drift Dry USA has a history of designing and manufacturing some of the most innovative apparel and accessories for the outdoor market. We are excited to work with them to take the DEVCORE and Drift Dry brands to the next level with new products to satisfy the needs of the most demanding users in the military, first responder, and other users, ” says Brian Miller, CEO of DEVCORE.

DEVCORE + Drift Dry USA products will leverage the expertise and experience from both teams and utilize cutting edge materials for its future products. Samples of Drift Dry products will be available at the DEVCORE booth and serve as a preview for the near future.

Please visit www.devcoregear.com

ABX Group Inc

5912 Bolsa Avenue, Suite 208

Huntington Beach, CA 92649

(800) 710-3650