Arbor Arms has knocked it out of the park again with their Innovation from the Roots Up.

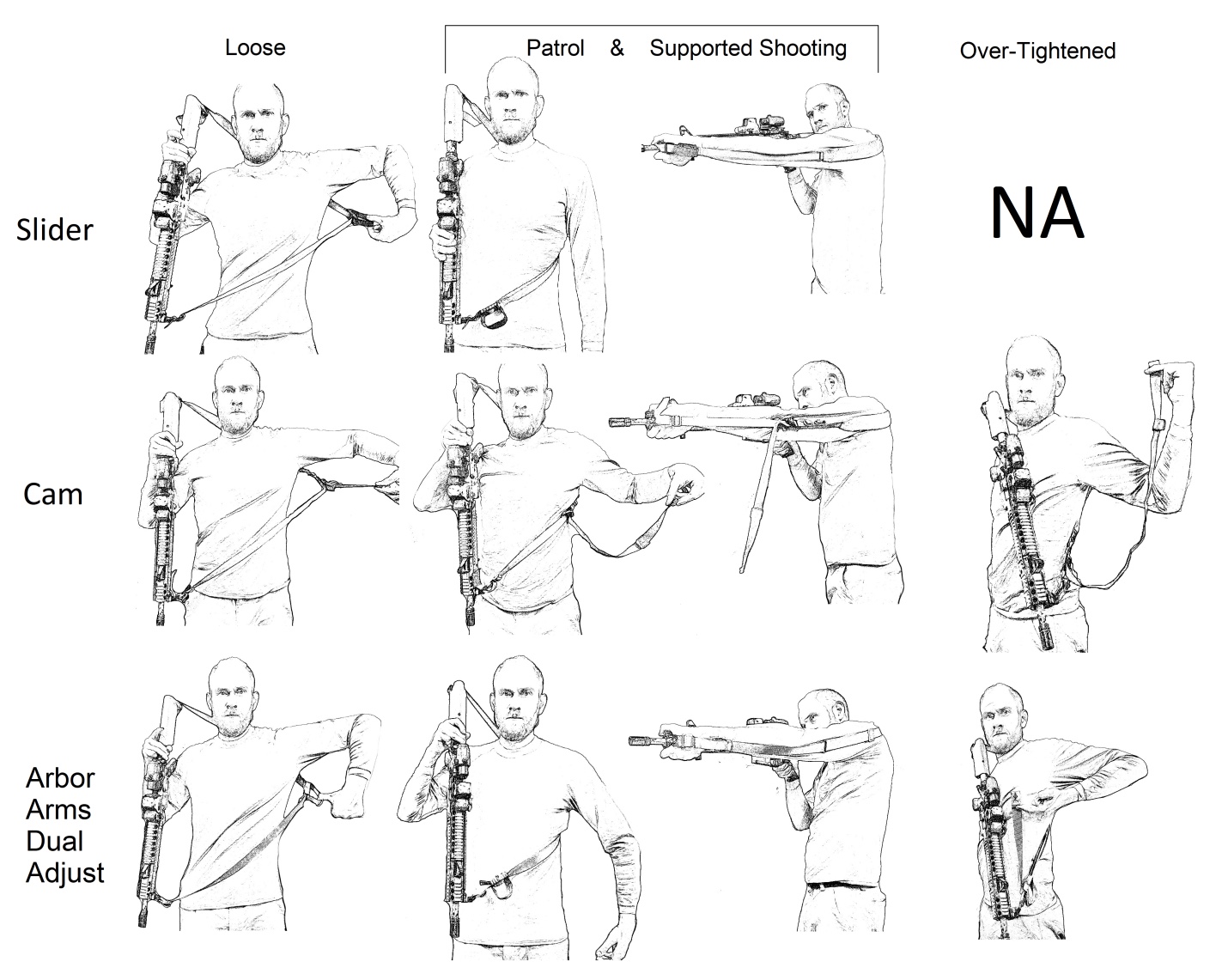

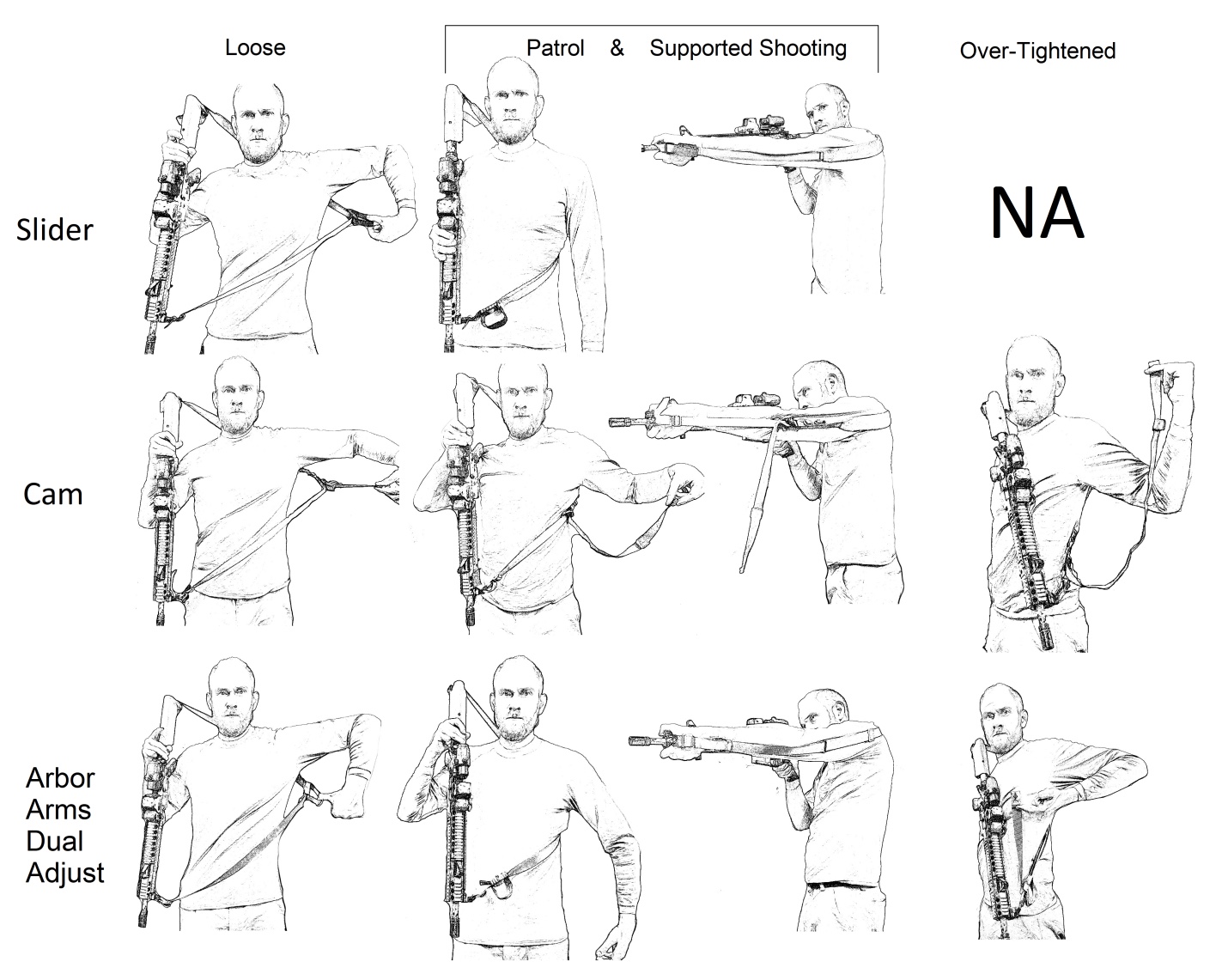

The Dual Adjust series of weapon slings are all based around their proprietary, patent pending sling hardware. What makes the DA unique is that it combines both a slider and a cam for over-tighten. It features a slider on one side for fast, smooth adjustment – from loose to patrol/supported shooting length. On the other side is a cam which allows the operator to over-tighten the sling. This brings the weapon tight to the body; be it for medical work, detention work, fast-roping or rappelling.

“Slider only” slings

Pros– Reaches both loose and patrol/supported shooting length with no tail,

Cons– Cannot be over tightened.

“Cam only” slings

Pros– Can be over tightened

Cons– Has a tail in all 3 positions

Arbor Arms Dual Adjust sling

Pros– Can reach both loose and patrol/supported shooting length with no tail, can also be over-tightened but with half as much tail as a cam only design.

Cons– NA

Another feature that all variations have is a girth/ length of pull adjustment on the back. This allows the sling to be fine-tuned for a perfect patrol/supported shooting length without touching the mounting points or cutting off excess webbing. This allows one sling to be adjusted from SBR to M107, skinny or yoked shooter, slick or in full kit, t-shirt or cold weather gear in two seconds.

The attachment points on both ends utilize a steel tri-glide with a red stripe on one side to help ensure that the tri-glides get properly back-locked when being installed.

Variations

The Dual Adjust series breaks down into 4 individual slings in 2 categories.

The standard weapon slings: Dual Adjust Carbine (DA-C) and the Dual Adjust Heavy (DA-H)

Precision Rifle System Slings: Dual Adjust PRS Light (DA-PRS-L) and the Dual Adjust PRS Heavy (DA-PRS-H)

The DA-C has lightweight acetyl ring that is designed to break at body weight for safety; the DA-H is built with a heavier welded steel ring for a more Murphy-proof construction.

Both DA-PRS slings start life as a DA-H then add an anchor point at the middle of the sling; we add both an arm cuff and a belt loop for anchor points. The difference between the Light and the Heavy is the DA-PRS-L utilizes a Duraflex snap-on and dual-split bar side release buckles as their anchor/ release mechanism. The DA-PRS-H uses stainless steel 1.5oz Snap-shackle with matching powder coat attached to loops of webbing.

Arbor Arms has also designed a pad that can be added on to any of the slings without conflicting with the girth/length of pull adjustment. Also, the Game Stalker Ammo Caddies can be added to this pad making it very applicable to the hunting market in addition to the tactical market.

All made in the US with US Materials, by a Disabled Veteran Owned Company with a very reasonable starting price of 59.99.

www.ArborArmsUSA.com