RED BANK, N.J. – August 8, 2013 – Brand & Oppenheimer Co., Inc. (“B&O”), a leading textile converter, announced today the appointment of David Mackney as Specialty Fabrics Business Manager.

Mackney, age 45, comes to B&O with nearly two decades of diverse hospitality and textile sales and marketing experience. Most recently, he served as Director of Sales & Marketing for the Specialty Products Group of Guilford Mills an integrated designer and producer of value-added knit fabrics using a broad range of technologies, located in Wilmington, NC. Mackney also held Regional Director & Sales/Marketing positions at Invista, Church Mutual Insurance and Hasbro Inc.

“We are pleased to welcome David to our company,” said Dan Pezold, President & CEO of B&O. “We are confident his marketplace experience, energy and passion in creating and building strong customer relationships will help drive B&O’s sales and serve to diversify our business segment within the Knit Fabric business and support our expansion within the hospitality and home design marketplace.”

B&O was founded in 1913 as a supplier of garment linings. In October 2011, Praesidian Capital, Stone Creek Capital, LLC and management acquired the company.

“We are pleased that David Mackney has decided to join the B&O team,” stated Jason Drattell, Founding Partner of Praesidian. “We know that Dan Pezold is bringing together the right talent to allow B&O to move its particular expertise into new markets.”

About Brand & Oppenheimer Co., Inc.

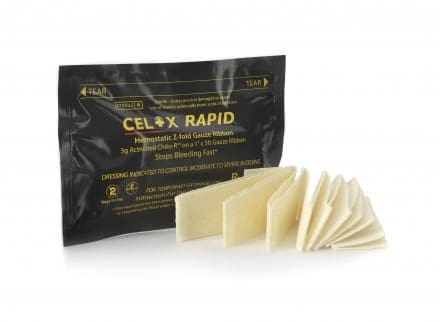

Brand & Oppenheimer Co., Inc., now in its centennial year, is a supplier to the textile industry. Based in Red Bank, N.J., B&O has distinguished itself in the past 15 years as a leader in textile conversion for the U.S. Military. The company is owned by B&O management, Praesidian Capital, and StoneCreek Capital, LLC.

About Praesidian Capital

Praesidian Capital partners with small and mid-sized businesses by providing private debt capital. With a focus on its core competency in mezzanine financing, Praesidian invests in established, historically profitable companies often in connection with a management/leveraged buyout, recapitalization or refinancing. Based in New York City, Praesidian manages more than $700 million in committed capital. For more information, visit www.praesidian.com.